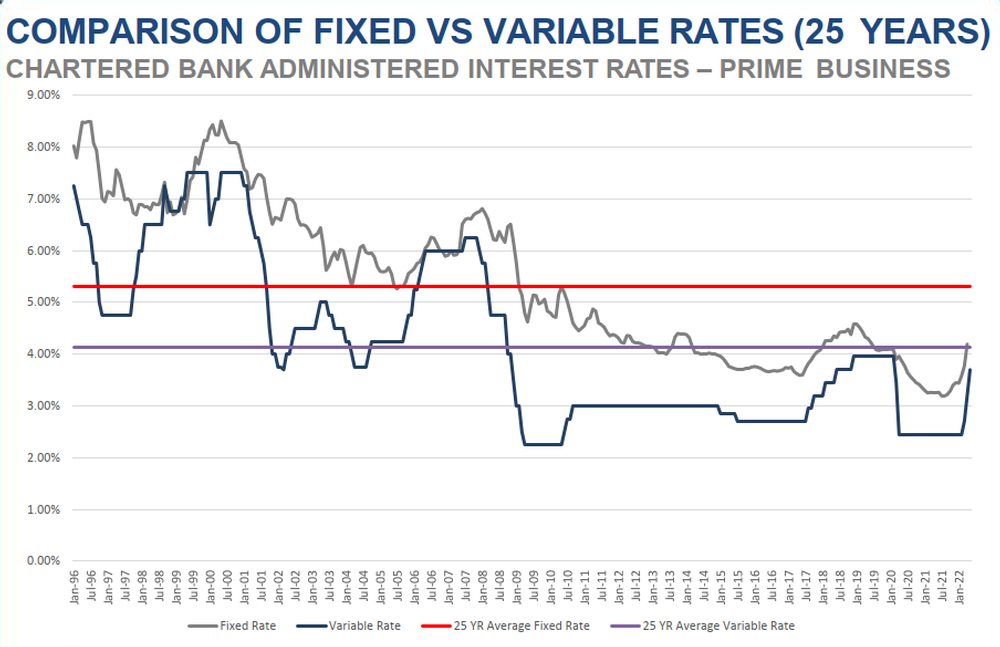

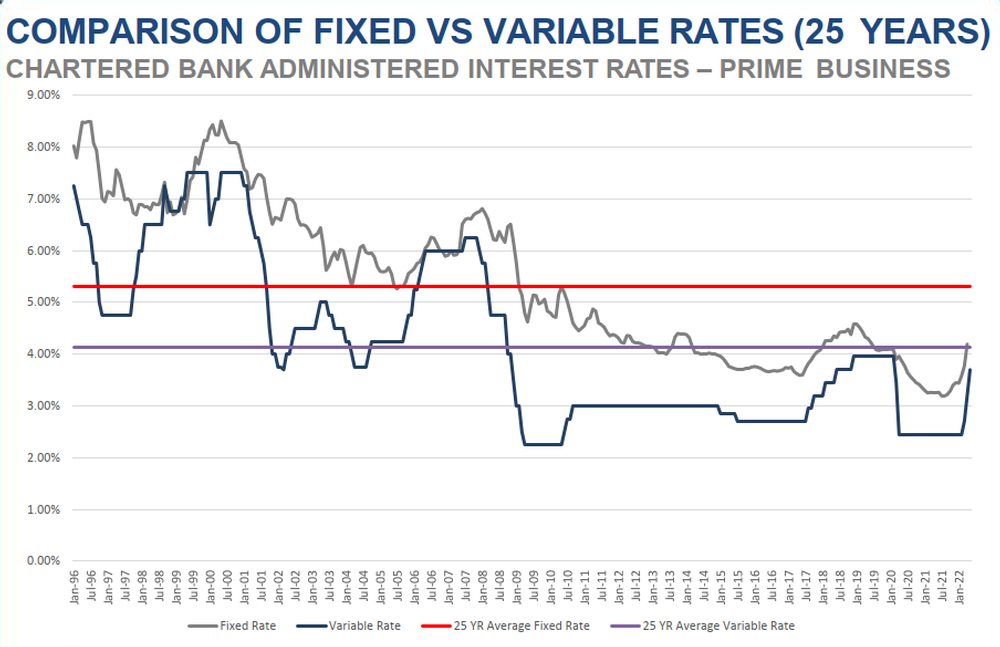

Here is a historical graph showing us that despite all of the recent rate increases, current mortgage rates are still comparatively low.

-

Putting Canadian mortgage interest rates into perspective

CLICK HERE TO READ THE FULL ARTICLE »

-

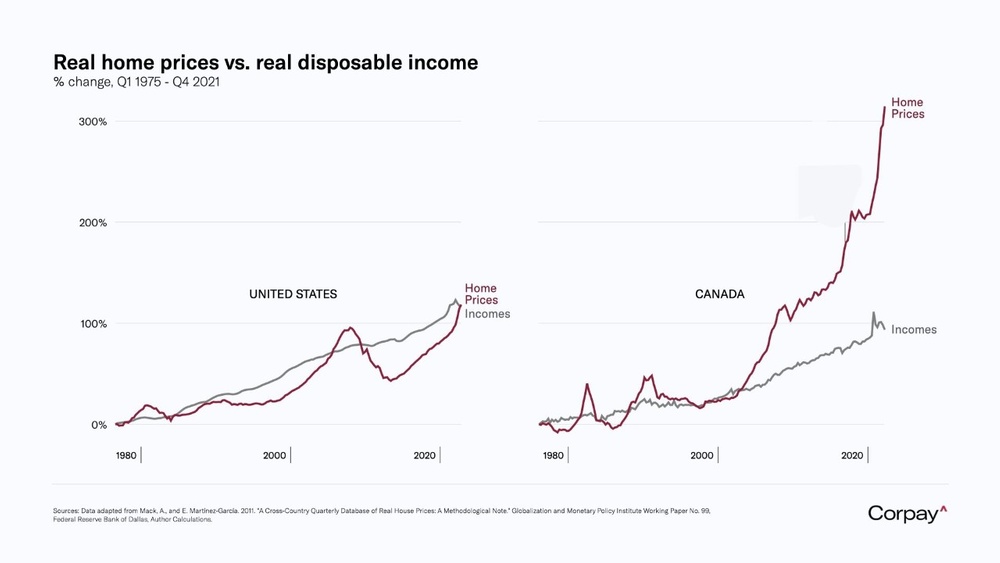

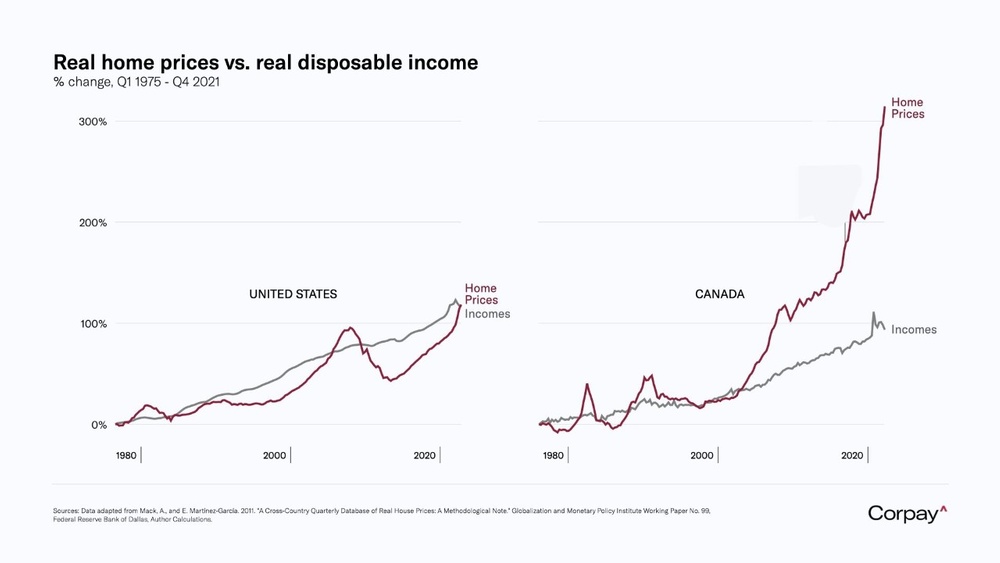

Is Canada in for a major real estate correction?

Take a look at the chart depicting the spread of home prices vs. disposable income for Canada and the United States

CLICK HERE TO READ THE FULL ARTICLE »

-

Everything to know about the Mortgage Stress Test

Canada’s mortgage stress test applies to anyone applying for or renewing a home loan through a federally regulated lender.

And apparently nearly half of Canadians (according to a poll conducted by TD Bank) don’t understand what the test is—or who it affects. Here’s your primer on the mortgage stress test!

CLICK HERE TO READ THE FULL ARTICLE »

-

5 Reasons Why Homebuyers May Not Qualify for the Mortgage Amount they Expected

Homebuyers will often enter the mortgage journey with expectations on the amount they expect to receive, only to be disappointed when they don’t qualify for that amount. This is especially unsettling when they’re already paying a monthly rental amount that exceeds how much the lender will allow their maximum monthly mortgage payment to be.

CLICK HERE TO READ THE FULL ARTICLE »

-

Why the recent mortgage rate hikes are lowering the qualifying amount

With the many increases to Mortgage Rates recently, mortgage borrowers are finding they are qualifying for lower mortgage amounts than they were just one month ago. This is true even in the absence of any change to the rate used by the dreaded Mortgage Stress Test.

CLICK HERE TO READ THE FULL ARTICLE »

-

First-time homebuyers facing pressure from existing homeowners

The Bank of Canada released a new study where, for the first time, it classified homebuyers into three distinct groups: first-time buyers, repeat buyers, and investors.

CLICK HERE TO READ THE FULL ARTICLE »

-

How to Save with a Variable Rate Mortgage

When it comes to mortgages, the age-old question remains: “Should I go with a variable or fixed-rate?”. To make an informed decision, it is important to assess your own risk tolerance & budget constraints more than historical trends.

CLICK HERE TO READ THE FULL ARTICLE »

-

Fixed-Rate Increases Costing Today’s Homebuyers Over $10,000 More in Interest

Fixed mortgage rates have been climbing steadily since September. But by how much at what cost for new homebuyers?

CLICK HERE TO READ THE FULL ARTICLE »

-

10 Mortgage Mistakes to Avoid

Whether it is your first house or you’re moving to a new neighborhood, getting approved for a mortgage is exciting! However, even if you have been approved and are simply waiting to close, there are still some things to keep in mind to ensure your efforts are successful.

To avoid having your mortgage approval status reversed or jeopardizing your financing, be sure to stay away from these 10 common mortgage mistakes.

CLICK HERE TO READ THE FULL ARTICLE »

-

Majority of Canadian Buyers Borrowing Their Maximum Approved Mortgage

Original Article Source Credits: Canadian Mortgage Trends, https://www.canadianmortgagetrends.com

Article Written By: Steve Huebl

Original Article Posted on:

Link to Original Article: https://www.canadianmortgagetrends.com/2021/07/majority-of-canadian-buyers-borrowing-their-maximum-approved-mortgage/

CLICK HERE TO READ THE FULL ARTICLE »

-

25 Secrets Your Banker Doesn't Want You to Know

Twenty-five or thirty years can sound like an impossibly long time to service a loan – and for many of us, it is. If you are looking to pay off your mortgage faster, here are some tried-and-true tactics to get you to financial freedom that much sooner!

CLICK HERE TO READ THE FULL ARTICLE »

-

First-Time Home Buyer Incentive "2.0" Now Available

Original Article Source Credits: Canadian Mortgage Trends, https://www.canadianmortgagetrends.com

Article Written By: Steve Huebl

Original Article Posted on:

Link to Original Article: https://www.canadianmortgagetrends.com/2021/05/first-time-home-buyer-incentive-2-0-now-available/

CLICK HERE TO READ THE FULL ARTICLE »

-

A Pre-Approval Does Not Guarantee a Mortgage Approval

Original Article Source Credits: Canadian Mortgage Trends, https://www.canadianmortgagetrends.com

Article Written By: Ross Taylor

Original Article Posted on:

Link to Original Article: https://www.canadianmortgagetrends.com/2021/04/a-pre-approval-does-not-guarantee-a-mortgage-approval/

CLICK HERE TO READ THE FULL ARTICLE »

-

Three of the Most Affordable Cities in Ontario to Buy a Home Right Now

Original Article Source Credits: Toronto Storeys , https://torontostoreys.com/

Article Written By: Ainsley Smith

Original Article Posted on: February 1, 2021

Link to Original Article: https://torontostoreys.com/most-affordable-cities-ontario-orea-2021/

CLICK HERE TO READ THE FULL ARTICLE »

-

Ontario Government Rolls Out New Condo Buyers' Guide

Original Article Source Credits: Toronto Storeys , https://torontostoreys.com/

Article Written By: Ainsley Smith

Original Article Posted on: January 5, 2021

Link to Original Article: https://torontostoreys.com/ontario-condo-buyers-guide/

CLICK HERE TO READ THE FULL ARTICLE »

-

Flight To The Burbs: Every Real Estate Market In Ontario Is Outperforming Toronto

Original Article Source Credits: Better Dwelling , https://betterdwelling.com/

Article Written By: NA

Original Article Posted on:

Link to Original Article: https://betterdwelling.com/flight-to-the-burbs-every-real-estate-market-in-ontario-is-outperforming-toronto/

CLICK HERE TO READ THE FULL ARTICLE »

-

First-Time Home Buyer Incentive to Become More Useful in Select Markets

Original Article Source Credits: CANADIAN MORTGAGE TRENDS , https://www.canadianmortgagetrends.com/

Article Written By: Steve Huebl

Original Article Posted on: December 4, 2020

Link to Original Article: https://www.canadianmortgagetrends.com/2020/12/first-time-home-buyer-incentive-to-become-more-useful-in-select-markets/

CLICK HERE TO READ THE FULL ARTICLE »

-

Canada's Average House Price Soars 17.5% In 'Very Strange Year'

Original Article Source Credits: HuffingtonPost , https://www.huffingtonpost.ca/

Article Written By: HuffPost Canada Staff

Original Article Posted on: 10/15/2020

Link to Original Article: https://www.huffingtonpost.ca/entry/house-prices-canada_ca_5f885d31c5b681f7da1f5dc8

CLICK HERE TO READ THE FULL ARTICLE »

-

The psychology of buying a house: Is it a key to happiness or just a source of stress?

Original Article Source Credits: CNBC, https://www.cnbc.com/

Article Written By: Cory Stieg

Original Article Posted on: October 27, 2020

Link to Original Article: https://www.cnbc.com/2020/10/27/does-buying-a-home-make-you-happier-psychology-of-home-ownership.html

CLICK HERE TO READ THE FULL ARTICLE »

-

Getting a mortgage when you're New to Canada

Canada has made buying a home for new Canadians as easy as ever through its New to Canada mortgage program. A Sleep Easy Financial licensed mortgage professional can help you navigate through the process.

CLICK HERE TO READ THE FULL ARTICLE »

How can we help?

Get in touch with us or Start your journey.