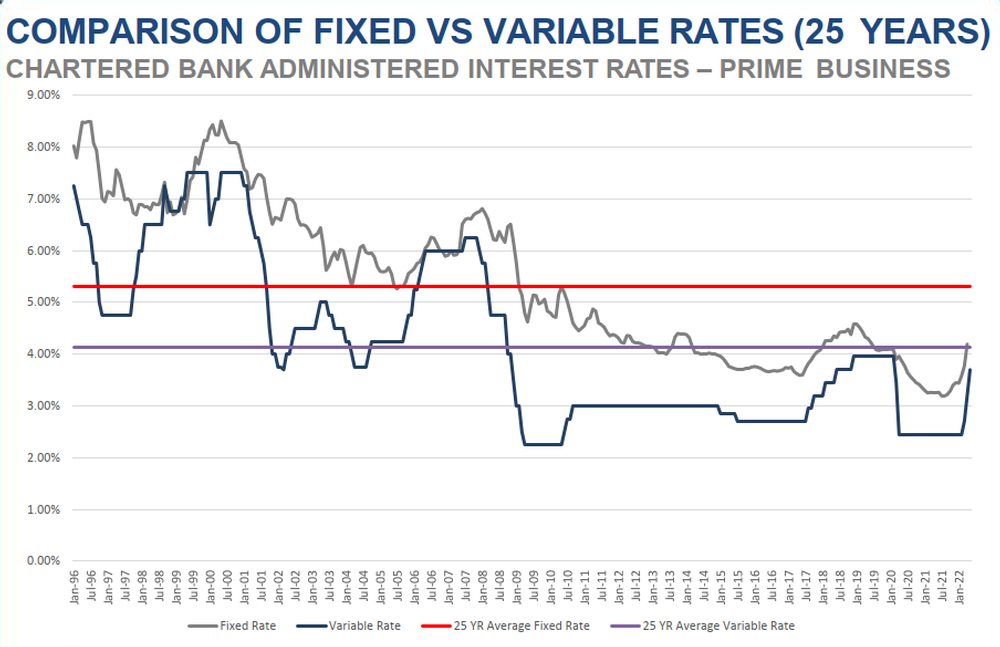

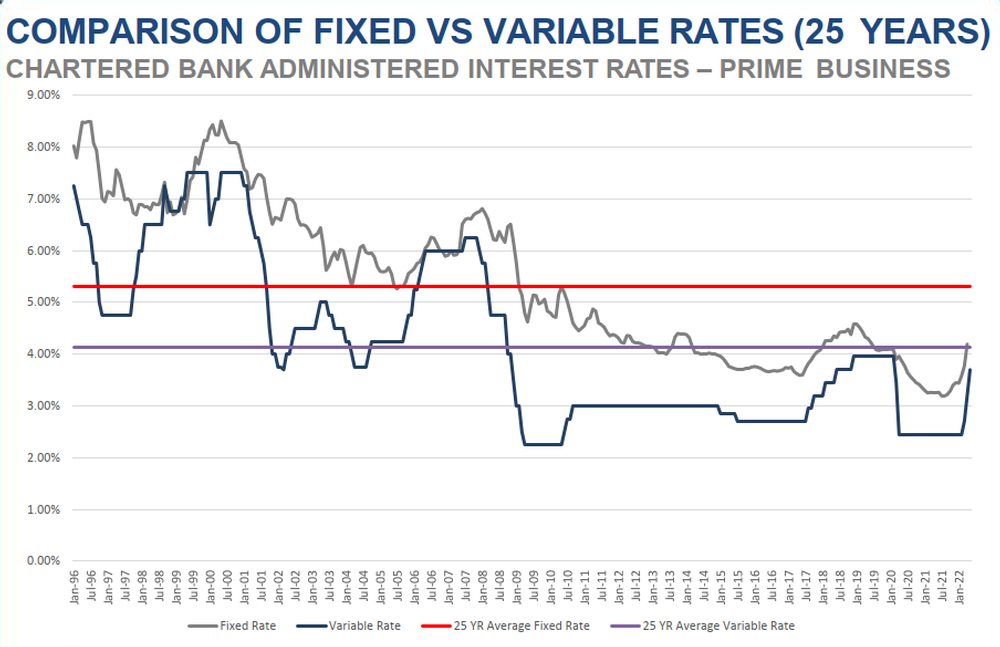

Here is a historical graph showing us that despite all of the recent rate increases, current mortgage rates are still comparatively low.

-

Putting Canadian mortgage interest rates into perspective

CLICK HERE TO READ THE FULL ARTICLE »

-

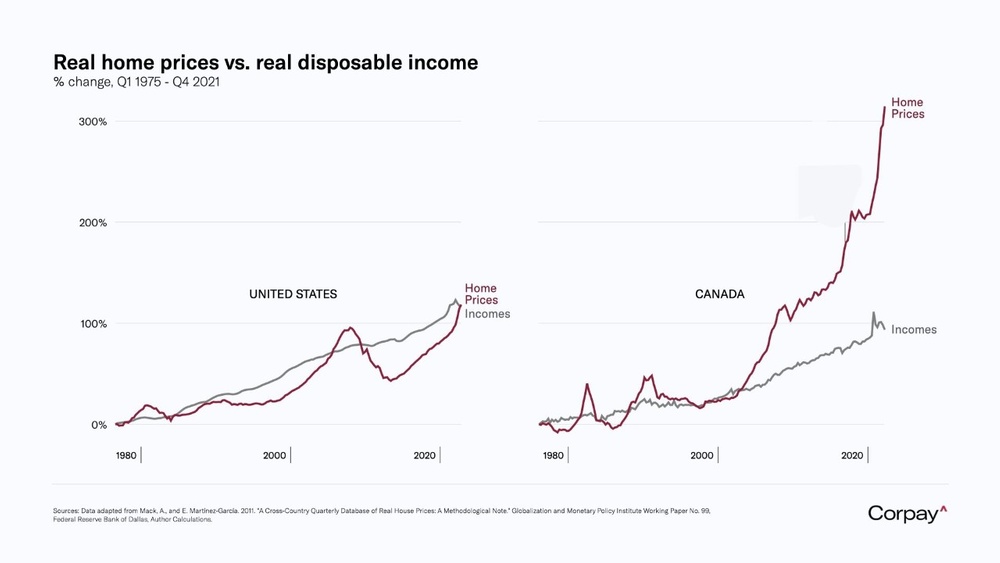

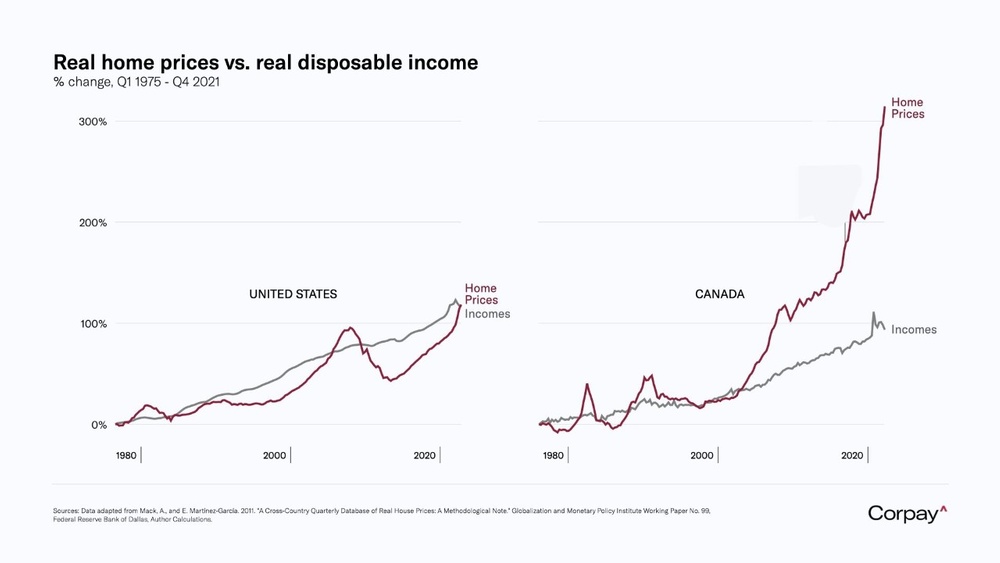

Is Canada in for a major real estate correction?

Take a look at the chart depicting the spread of home prices vs. disposable income for Canada and the United States

CLICK HERE TO READ THE FULL ARTICLE »

-

Everything to know about the Mortgage Stress Test

Canada’s mortgage stress test applies to anyone applying for or renewing a home loan through a federally regulated lender.

And apparently nearly half of Canadians (according to a poll conducted by TD Bank) don’t understand what the test is—or who it affects. Here’s your primer on the mortgage stress test!

CLICK HERE TO READ THE FULL ARTICLE »

-

5 Reasons Why Homebuyers May Not Qualify for the Mortgage Amount they Expected

Homebuyers will often enter the mortgage journey with expectations on the amount they expect to receive, only to be disappointed when they don’t qualify for that amount. This is especially unsettling when they’re already paying a monthly rental amount that exceeds how much the lender will allow their maximum monthly mortgage payment to be.

CLICK HERE TO READ THE FULL ARTICLE »

-

Why the recent mortgage rate hikes are lowering the qualifying amount

With the many increases to Mortgage Rates recently, mortgage borrowers are finding they are qualifying for lower mortgage amounts than they were just one month ago. This is true even in the absence of any change to the rate used by the dreaded Mortgage Stress Test.

CLICK HERE TO READ THE FULL ARTICLE »

-

Fixed-Rate Increases Costing Today’s Homebuyers Over $10,000 More in Interest

Fixed mortgage rates have been climbing steadily since September. But by how much at what cost for new homebuyers?

CLICK HERE TO READ THE FULL ARTICLE »

-

10 Mortgage Mistakes to Avoid

Whether it is your first house or you’re moving to a new neighborhood, getting approved for a mortgage is exciting! However, even if you have been approved and are simply waiting to close, there are still some things to keep in mind to ensure your efforts are successful.

To avoid having your mortgage approval status reversed or jeopardizing your financing, be sure to stay away from these 10 common mortgage mistakes.

CLICK HERE TO READ THE FULL ARTICLE »

-

Majority of Canadian Buyers Borrowing Their Maximum Approved Mortgage

Original Article Source Credits: Canadian Mortgage Trends, https://www.canadianmortgagetrends.com

Article Written By: Steve Huebl

Original Article Posted on:

Link to Original Article: https://www.canadianmortgagetrends.com/2021/07/majority-of-canadian-buyers-borrowing-their-maximum-approved-mortgage/

CLICK HERE TO READ THE FULL ARTICLE »

-

25 Secrets Your Banker Doesn't Want You to Know

Twenty-five or thirty years can sound like an impossibly long time to service a loan – and for many of us, it is. If you are looking to pay off your mortgage faster, here are some tried-and-true tactics to get you to financial freedom that much sooner!

CLICK HERE TO READ THE FULL ARTICLE »

-

The Top 7 Misconceptions About Reverse Mortgages

How much do you really know about reverse mortgages? Maybe you know that reverse mortgages can help Canadians 55+ access the equity in their home, tax-free. Maybe you know that tens of thousands of Canadians are using a reverse mortgage as part of their financial plan. But did you know that there are 7 common misconceptions when it comes to understanding reverse mortgages in Canada. Common Misconceptions About Reverse Mortgages 1. If you have a reverse mortgage, you no longer own your home Nothing could be further from the truth. You always maintain title, ownership and control of your home – the lender simply…

CLICK HERE TO READ THE FULL ARTICLE »

-

First-Time Home Buyer Incentive "2.0" Now Available

Original Article Source Credits: Canadian Mortgage Trends, https://www.canadianmortgagetrends.com

Article Written By: Steve Huebl

Original Article Posted on:

Link to Original Article: https://www.canadianmortgagetrends.com/2021/05/first-time-home-buyer-incentive-2-0-now-available/

CLICK HERE TO READ THE FULL ARTICLE »

-

A Pre-Approval Does Not Guarantee a Mortgage Approval

Original Article Source Credits: Canadian Mortgage Trends, https://www.canadianmortgagetrends.com

Article Written By: Ross Taylor

Original Article Posted on:

Link to Original Article: https://www.canadianmortgagetrends.com/2021/04/a-pre-approval-does-not-guarantee-a-mortgage-approval/

CLICK HERE TO READ THE FULL ARTICLE »

-

Bank of Canada backs tighter mortgage stress test amid hot housing market

Original Article Source Credits: Financial Post, https://financialpost.com/

Article Written By: Bianca Bharti

Original Article Posted on:

Link to Original Article: https://financialpost.com/news/economy/bank-of-canada-backs-tighter-mortgage-stress-test-amid-hot-housing-market

CLICK HERE TO READ THE FULL ARTICLE »

-

The State of the Residential Mortgage Market: 2021

Original Article Source Credits: CANADIAN MORTGAGE TRENDS , https://www.canadianmortgagetrends.com/

Article Written By: Steve Huebl

Original Article Posted on: March 26, 2021

Link to Original Article: https://www.canadianmortgagetrends.com/2021/03/the-state-of-the-mortgage-market-2021/

CLICK HERE TO READ THE FULL ARTICLE »

-

Canada’s housing market is showing signs of overheating, CMHC says

Original Article Source Credits: Global News , https://globalnews.ca/

Article Written By: Tara Deschamps

Original Article Posted on: March 25, 2021

Link to Original Article: https://globalnews.ca/news/7719049/canada-housing-market-overheating-cmhc/

CLICK HERE TO READ THE FULL ARTICLE »

-

Residential mortgage loans extended by non-bank lenders grew by 40.7% in the third quarter of 2020

Original Article Source Credits: Statistics Canada , https://www.statcan.gc.ca/eng

Article Written By: NA

Original Article Posted on: MARCH 3, 2021

Link to Original Article: https://www150.statcan.gc.ca/n1/daily-quotidien/210303/dq210303c-eng.htm

CLICK HERE TO READ THE FULL ARTICLE »

-

Why Isn’t My Credit Score Showing Up?

Original Article Source Credits: Loans Canada , https://loanscanada.ca/

Article Written By: BRYAN DALY

Original Article Posted on: NA

Link to Original Article: https://loanscanada.ca/credit/why-isnt-my-credit-score-showing-up/

CLICK HERE TO READ THE FULL ARTICLE »

-

Canadian Real Estate Saw A “Typical” Home Price Rise Up To $73,000 Just Last Month

Original Article Source Credits: Better Dwelling , https://betterdwelling.com/

Article Written By: Kaitlin Last

Original Article Posted on:

Link to Original Article: https://betterdwelling.com/canadian-real-estate-saw-a-typical-home-price-rise-up-to-73000-just-last-month/

CLICK HERE TO READ THE FULL ARTICLE »

-

Could Mortgage Rates Start to Rise Sooner than Expected?

Original Article Source Credits: CANADIAN MORTGAGE TRENDS , https://www.canadianmortgagetrends.com/

Article Written By: Steve Huebl

Original Article Posted on: February 2, 2021

Link to Original Article: https://www.canadianmortgagetrends.com/2021/02/could-mortgage-rates-start-to-rise-sooner-than-expected/

CLICK HERE TO READ THE FULL ARTICLE »

-

Housing Market Overcomes 2020's Obstacles for Third-Best Year on Record

Original Article Source Credits: UrbanToronto , https://urbantoronto.ca/

Article Written By: Jack Landau

Original Article Posted on: January 6, 2021

Link to Original Article: https://urbantoronto.ca/news/2021/01/housing-market-overcomes-2020s-obstacles-third-best-year-record

CLICK HERE TO READ THE FULL ARTICLE »

How can we help?

Get in touch with us or Start your journey.